NEWS AREA

NEWS TO NEWS

Breaking News

เปิดระเบียบราชทัณฑ์66 คุมขังนอกเรือนจำ เผย 4 ข้อกำหนด เอื้อ ทักษิณ หรือไม่

รวบสาวจีน ไลฟ์ซอยนานาอันตราย พบลอบขายของออนไลน์ในไทย จ่อแบล็กลิสต์

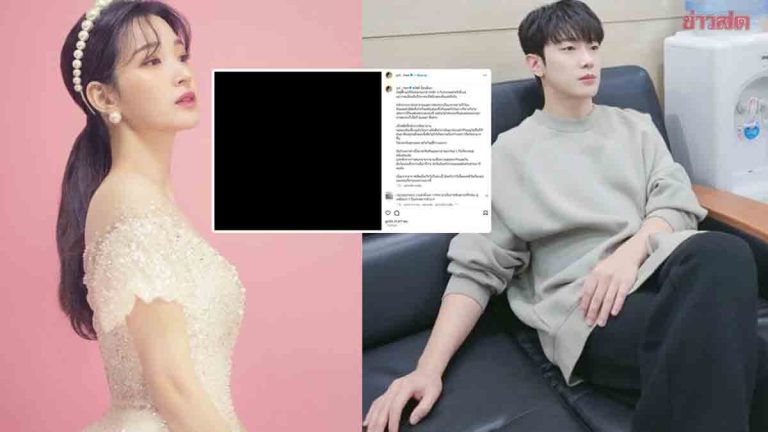

เนสกาแฟ ศรีนคร โพสต์เศร้า ไปต่อไม่ไหว เลิกแฟนหนุ่ม ฝ่ายชายโผล่คอมเมนต์

แฟนคลับช็อกเลิกอีกคู่ ประกาศยุติสถานะสามีภรรยา คู่รักไอดอลดัง ยังทำหน้าที่พ่อแม่